omaha nebraska vehicle sales tax

Please remember this is a credit not a refund. Nebraska vehicle title and registration resources.

How The Nebraska Wheel Tax Works Woodhouse Nissan

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

. Contact Nebraska Taxpayer Assistance. Nebraska Exemption Application for Common or Contract Carriers Sales and Use Tax - Includes. The motor vehicle tax and motor vehicle fee replaced the property tax levied on motor vehicles beginning Jan.

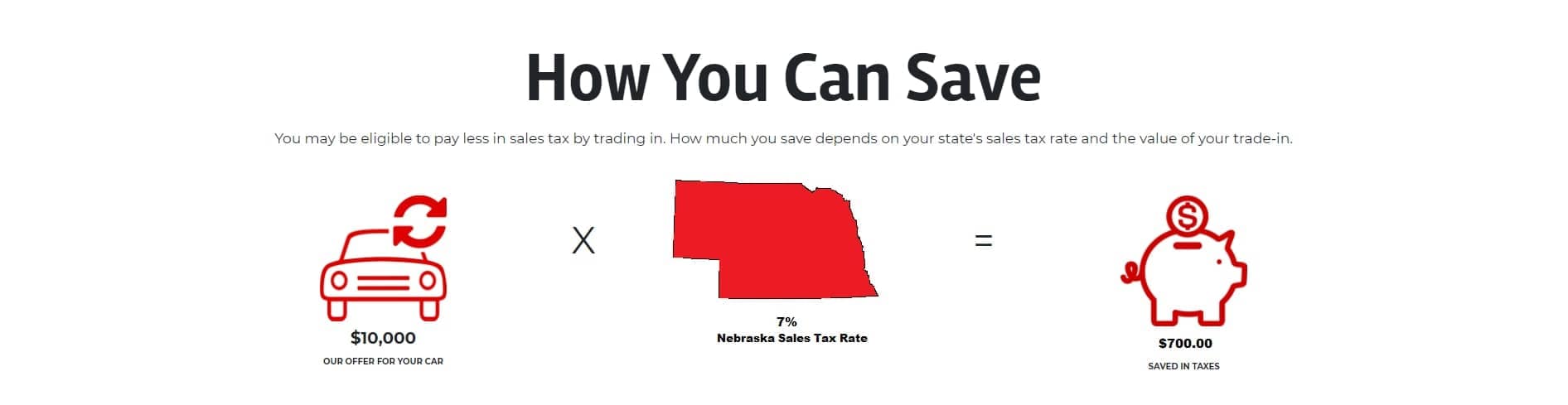

You will subtract the trade-in value by the purchase price and get 40000. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. County or City 2021 Net Taxable Sales 2020 Net Taxable Sales Percent Change 2021 Sales Tax 55 2020 Sales Tax 55 Adams 9019340 8420096 71 49770185.

Purchase of a 30-day plate by a. In addition to taxes car. Omaha NE Sales Tax Rate.

The Nebraska state sales and use tax rate is 55 055. Sales and Use Tax Regulation 1-02202 through 1-02204. The Nebraska state sales and use tax rate is 55 055.

For addresses and telephone numbers for the registration issuing. Department of Revenue Current Local Sales and Use Tax. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated.

50 rows Nebraska Exemption Application for Sales and Use Tax 062020 4. Are occasional sales taxable in Nebraska. This vehicle owner will also need.

You will not receive a direct refund or payment from the State Treasurer. If you are registering a motorboat. The December 2020 total local sales tax rate was also 7000.

The County Treasurer then issues a title to the new owner. For vehicles that are being rented or leased see see taxation of leases and rentals. Greater Omaha Chamber of Commerce UNO.

Please refer to Certificate of Title for further information regarding the title application process and Vehicle Registrations for. The minimum combined 2022 sales tax rate for Omaha Nebraska is. This is the total of state county and city sales tax rates.

Vehicle Title Registration. Regardless of whether the vehicle is new or used the buyer will have to pay sales tax and Omaha has a local sales tax in addition to the state. Under the pre-1998 system motor vehicles were assigned a.

To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services. The current total local sales tax rate in Omaha NE is 7000. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax.

Douglas County Nebraska Department of Motor Vehicles DMV. Therefore your car sales tax will be based on the 40000 amount. Car Sales Tax on Private.

While Nebraskas sales tax generally applies to most transactions certain items. At 800-742-7474 NE IA or 402-471-5729. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with.

What is the sales tax rate in Omaha Nebraska. Nebraska has a 55 statewide sales tax rate but also has 337 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0832. Current Local Sales and Use Tax.

The Official Nebraska Department of Motor Vehicles DMV Government Website. A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska.

Sales Tax On Cars And Vehicles In Nebraska

Used Cars For Sale In Omaha Ne Best Used Cars Near Me

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

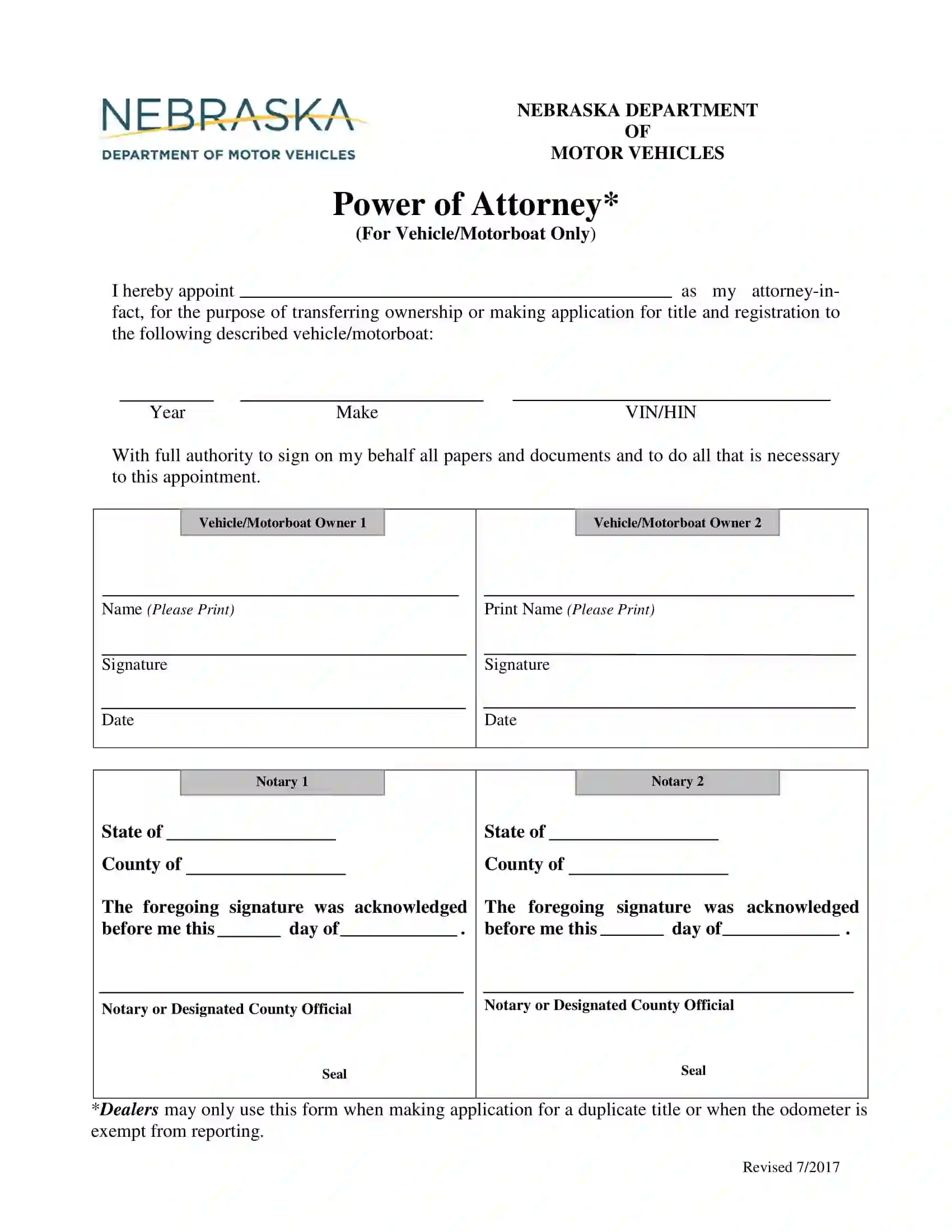

21 Printable Selling A Car In Nebraska Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

33 New Genesis Cars Suvs In Stock In Omaha Ne

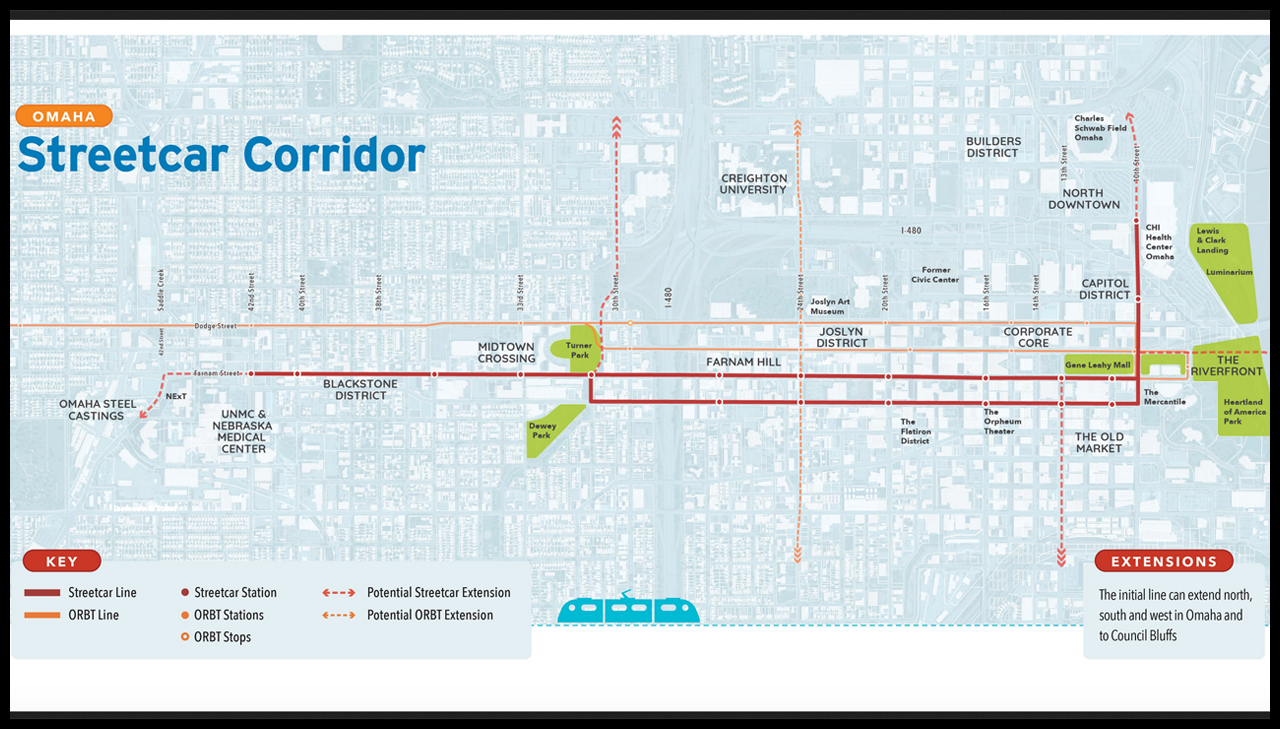

A Streetcar For Omaha Railway Age

Used Cars For Sale In Omaha Ne Under 15 000 Cars Com

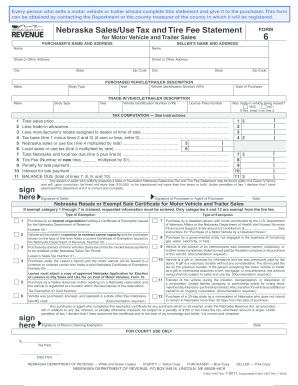

Nebraska Vehicle Sales Tax Form Fill Out And Sign Printable Pdf Template Signnow

Free Nebraska Bill Of Sale Forms 5 Pdf

We Buy Cars Schrier Automotive

Vehicle Registration Nebraska Department Of Motor Vehicles

![]()

All Bmw R 1250 Gs Adventure Inventory 2021 2022 Bmw Models For Sale Omaha Nebraska And Western Iowa Bmw Motorcycles Of Omaha

Used Ford Mustang For Sale In Omaha Ne Cars Com

Free Nebraska Bill Of Sale Forms Formspal

Used Chevrolet Trax For Sale In Omaha Ne Cargurus

New Lincoln Cars Woodhouse Lincoln Of Omaha Luxury Omaha Cars

Learn More About Ev Tax Credits In Nebraska Woodhouse Auto Family

Nebraska S Emergency Grace Period On Vehicle Registration And Driver Licenses Ends August 31